For decades, precious metals like gold and silver have dominated the investment landscape, prized for their stability and status as safe-haven assets. However, a shift is occurring as common metals—such as copper, aluminum, and nickel—gain traction as viable investment options. Driven by industrial growth, green energy initiatives, and large-scale infrastructure projects, these metals are becoming increasingly attractive to investors seeking diversification and long-term growth potential. This article explores the growing trend of investing in common metals, examining the factors behind their rising demand and their role in shaping the future of the investment market.

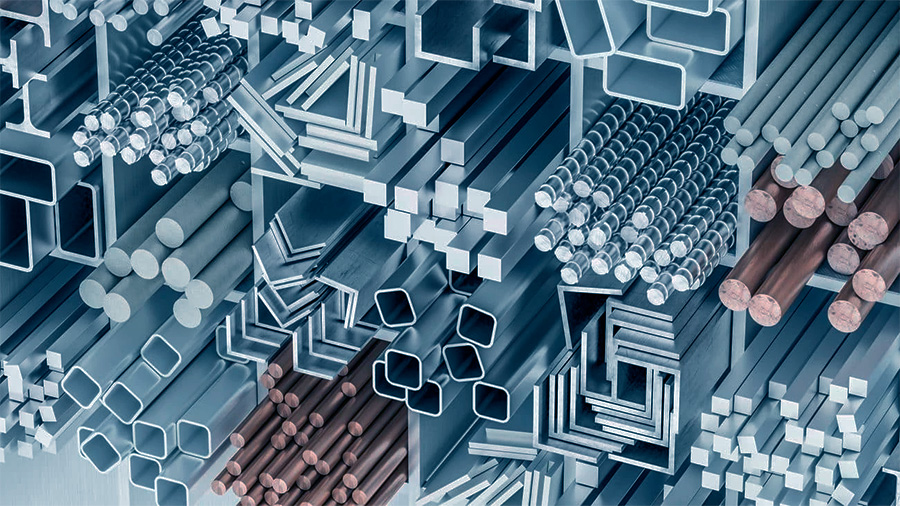

What Are Common Metals?

Common metals, also known as base or industrial metals, are non-precious metals widely used in construction, manufacturing, and technology. Unlike precious metals, their value is derived primarily from industrial demand rather than rarity or aesthetic appeal.

Examples of Common Metals

- Copper: Used in electrical wiring, construction, and renewable energy systems.

- Aluminum: Lightweight and corrosion-resistant, ideal for transportation and packaging industries.

- Nickel: Essential for stainless steel production and battery manufacturing.

- Zinc: Primarily used for galvanizing steel to prevent corrosion.

- Iron and Steel: Core materials for construction and infrastructure projects.

The Appeal of Common Metals

The widespread utility and versatility of common metals make them indispensable in modern economies. As industries expand and technologies evolve, the demand for these metals continues to rise, positioning them as strategic assets for investors.

Factors Driving Demand for Common MetalsThe growing interest in common metals as investment opportunities can be attributed to several key factors, ranging from global industrialization to sustainability initiatives.

Industrial Growth

Emerging economies, particularly in Asia and Africa, are experiencing rapid industrialization, driving demand for construction materials and manufacturing inputs. For example, China’s ongoing urbanization efforts have significantly increased the consumption of steel, aluminum, and copper for building infrastructure and producing goods.

Additionally, established economies continue to rely on common metals for maintenance and upgrades to existing facilities, ensuring consistent demand across global markets.

Green Energy Transition

As the world shifts toward renewable energy, common metals play a pivotal role in building the necessary infrastructure. Copper, for instance, is essential for solar panels, wind turbines, and electric vehicle (EV) charging stations due to its high conductivity. Similarly, nickel and aluminum are critical for EV batteries and lightweight vehicle components, supporting the transition to cleaner transportation.

This surge in green energy initiatives has created new opportunities for investors to capitalize on the rising demand for common metals in sustainable industries.

Global Infrastructure Projects

Massive infrastructure investments, such as roads, bridges, railways, and smart cities, rely heavily on common metals. Governments worldwide are allocating significant budgets to modernize transportation systems and build resilient infrastructure to support growing populations. These projects create sustained demand for metals like iron, steel, and aluminum, driving their value in the investment market.

Technological Advancements

Technological innovations, particularly in electronics and telecommunications, have increased the need for high-quality metals. Copper and aluminum are vital for producing smartphones, computers, and data centers, while nickel is used in advanced batteries and energy storage solutions. As technology continues to evolve, the demand for these metals is expected to grow, enhancing their investment appeal.

Investment Opportunities in Common Metals

Investors have various avenues to gain exposure to common metals, ranging from physical assets to financial instruments. Each option offers unique benefits and risks, catering to different investment strategies.

Physical Metals

Buying physical metals, such as copper or aluminum bars, allows investors to directly own the asset. This approach provides a tangible hedge against inflation and currency fluctuations but requires secure storage solutions, which can add to the overall cost.

Futures Contracts

Futures contracts allow investors to speculate on the future price movements of common metals. These financial instruments are ideal for short-term traders seeking to capitalize on market volatility but involve significant risk due to their leveraged nature.

Exchange-Traded Funds (ETFs)

ETFs focused on common metals provide diversified exposure without the need to manage physical assets. For example, the Global X Copper Miners ETF offers access to companies involved in copper extraction and production, enabling investors to benefit from rising metal prices.

Mining Stocks

Investing in mining companies offers indirect exposure to common metals. Stocks of firms like Rio Tinto, BHP, and Vale are linked to the production and profitability of metals like iron, copper, and aluminum. This option combines the potential for high returns with the risks associated with corporate performance and market conditions.

Recycling and Secondary Markets

The growing emphasis on sustainability has increased the importance of recycled metals. Investing in companies specializing in metal recycling aligns with environmental goals while tapping into a burgeoning market driven by circular economy principles.

Risks and Challenges of Investing in Common Metals

While common metals offer significant opportunities, they also come with inherent risks that investors must consider before committing their capital.

Market Volatility

Prices of common metals are influenced by global economic conditions, geopolitical events, and supply chain disruptions. For example, trade restrictions or mining strikes can cause sudden price fluctuations, impacting investment returns.

Environmental and Regulatory Concerns

The extraction and production of common metals often involve environmental challenges, such as habitat destruction and carbon emissions. Stricter regulations and societal pressure to adopt greener practices may increase operational costs for mining companies, affecting profitability.

Economic Cycles

Demand for common metals is closely tied to economic activity. During recessions, reduced industrial output and construction slow the demand for metals, leading to price declines. Investors must be prepared for these cyclical variations and plan accordingly.

Why Common Metals Are Gaining Investor Interest

The rising interest in common metals reflects broader shifts in the global economy and investment strategies.

Diversification Benefits

Common metals offer diversification for portfolios heavily weighted in traditional assets like stocks, bonds, or precious metals. Their performance is often influenced by industrial and technological trends, providing a counterbalance to other asset classes.

Alignment with Sustainability Goals

Investors increasingly prioritize sustainability, and common metals play a crucial role in renewable energy, electric vehicles, and green infrastructure. Supporting these industries aligns with ethical investment goals while tapping into sectors with significant growth potential.

Inflation Hedge

Like precious metals, common metals can serve as a hedge against inflation. As raw materials, their prices often rise with increasing production costs, preserving purchasing power for investors.

The Conclusion

Common metals are emerging as a compelling investment option, driven by industrial growth, green energy initiatives, and infrastructure development. While they present unique opportunities for diversification and long-term growth, investors must navigate challenges like market volatility and environmental concerns. By understanding the dynamics of these markets and leveraging tools like ETFs, mining stocks, and recycling ventures, investors can capitalize on the growing demand for common metals. As the world transitions to a more sustainable and interconnected economy, these metals are poised to play a pivotal role in shaping the future of investment strategies.